Understanding the Loan Process

Before you fall in love with a home, it’s important to understand how the loan process works in Kentucky. Mortgages follow a structured path, and knowing each stage can save time, reduce stress, and help you move from offer to closing with confidence. Whether you’re applying for a conventional loan, FHA, VA, or USDA program, the general flow is the same:

Step-by-Step Loan Process in Kentucky

Pre-Approval

Meet with a trusted Kentucky lender to review your credit, income, and debt. A strong pre-approval letter tells sellers you’re serious and ready to buy, giving you an edge in a competitive market. This step also clarifies your budget and estimated monthly payment.

Application

Once you’ve found the right home, you’ll complete a formal mortgage application. Expect to provide pay stubs, tax returns, bank statements, and authorization for a credit check. This locks in your request for financing and starts the approval clock.

Processing

The lender’s team verifies employment, income, assets, and the property’s details. They’ll order an appraisal and review your financial history to confirm you can repay the loan. Quick responses to documentation requests help keep this stage moving smoothly.

Underwriting

An underwriter carefully evaluates the loan for risk and ensures it meets FHA, VA, USDA, or conventional guidelines. They may issue “conditions” such as clarifications or extra documents that must be satisfied before approval can be granted.

Clear to Close

When all conditions are met, the lender issues a final approval and prepares your Closing Disclosure. At this point, you’re cleared to sign. Your closing date is scheduled, and final figures are locked in, including down payment and cash-to-close.

Funding

On closing day, the lender releases funds, the deed is recorded with the county, and you officially become the owner. This is the moment you receive your keys and step into your new Kentucky home with confidence.

Not sure if your credit is ready?

Check the credit score you’ll need to buy a home in Kentucky and start planning your path to pre-approval today.

View Credit Score RequirementsCommon Loan Programs in Kentucky

Kentucky home buyers have a wide range of mortgage options, from traditional conventional financing to specialized programs backed by the government or the Kentucky Housing Corporation. Understanding the differences—including down payment rules, credit score requirements, and whether the loan is fixed-rate or adjustable (ARM)—will help you choose the program that best fits your long-term goals.

CONVENTIONAL LOANS

Conventional mortgages are the most common choice for Kentucky buyers.

➤ Down Payment: Minimum 3% for first-time buyers, 5% for repeat buyers; 20% avoids PMI.

➤ Credit Score: Typically 620+; higher scores get better rates.

➤ PMI: Required under 20% down, cancellable once 20% equity is reached.

➤ Fixed or ARM: Available as both fixed-rate (15, 20, 30-year terms) or adjustable-rate (commonly 5/6, 7/6, or 10/6 ARMs).

➤ Pros: Flexible loan limits, competitive rates, no upfront mortgage insurance.

➤ Cons: Stricter credit and debt-to-income guidelines compared to FHA or USDA.

FHA LOANS

VA LOANS

USDA LOANS

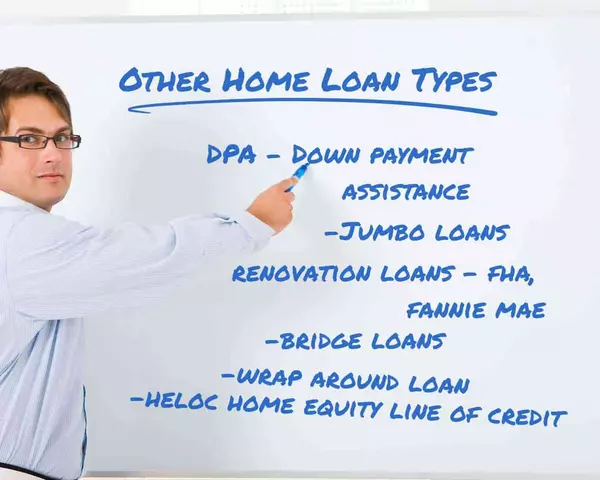

OTHER PROGRAMS

Compare Popular Kentucky Mortgage Loan Options

Mortgage Loan Comparison Chart

Conventional

- Min down:

- 3–5% (20% avoids PMI)

- Typical credit:

- 620+

- Fixed/ARM:

- Fixed (15–30 yr) & ARM

- Pros:

- Flexible terms, PMI removable, competitive rates

- Cons:

- Stricter credit/DTI

FHA

- Min down:

- 3.5% (580+); 10% if 500–579

- Typical credit:

- 580+ (500–579 needs 10% down)

- Fixed/ARM:

- Fixed (15/30 yr), some ARMs

- Pros:

- Easier approval, low down payment

- Cons:

- Upfront + monthly MIP, lower loan limits

KHC Assistance (Kentucky Housing Corporation)

- Min down:

- Varies (paired with FHA/VA/USDA/Conventional)

- Typical credit:

- Per paired loan

- Fixed/ARM:

- Per paired loan

- Pros:

- Helps cover down payment/closing costs

- Cons:

- Often a second lien; terms vary

VA

- Min down:

- 0%

- Typical credit:

- ~620 (lender varies)

- Fixed/ARM:

- Fixed & ARM

- Pros:

- No PMI, competitive rates, capped fees

- Cons:

- Eligibility required, primary residences only

Jumbo

- Min down:

- 10–20%

- Typical credit:

- 700+

- Fixed/ARM:

- Fixed & ARM

- Pros:

- Finances high-value homes

- Cons:

- Higher rates, stricter reserves/DTI

USDA

- Min down:

- 0%

- Typical credit:

- ~620

- Fixed/ARM:

- Mostly 30-year fixed

- Pros:

- Zero down for rural buyers

- Cons:

- Area/income limits, guarantee fee

Renovation (FHA 203k, HomeStyle)

- Min down:

- 3.5% (203k) or 5% (HomeStyle)

- Typical credit:

- ~620+

- Fixed/ARM:

- Fixed & ARM

- Pros:

- Purchase + rehab in one loan

- Cons:

- More paperwork, longer timelines

Bridge Loan

- Equity:

- Typically 20%+ in current home

- Typical credit:

- ~660+

- Fixed/ARM:

- Fixed or short-term ARM

- Pros:

- Buy before you sell

- Cons:

- Higher rates, temporary financing

Wraparound Loan

- Min down:

- Negotiated (seller-financed)

- Typical credit:

- Varies

- Fixed/ARM:

- Usually fixed

- Pros:

- Creative option when traditional financing is limited

- Cons:

- Legal/servicing risks; depends on seller’s existing loan

HELOC (Home Equity Line Of Credit)

- Equity:

- Usually 15–20% required

- Typical credit:

- ~640+

- Rate type:

- Variable

- Pros:

- Flexible line for projects

- Cons:

- Rate can rise; secured by home

Continue Learning

Compare loans, then take your next step with these resources.

4 Categories of Mortgage Documents Homebuyers Need

Loan Application Documents

➤ Government-issued photo ID; Social Security number.

➤ Income: last 30 days of pay stubs; W-2s/1099s (2 years); federal tax returns (2 years).

➤ Employment: employer contact/VOE; self-employed: YTD P&L + two years business returns.

➤ Bank statements (most recent 2 months).

➤ Source of funds: statements showing down-payment/earnest money; gift letter if applicable

Credit & Asset Verification

➤ Asset documentation (checking/savings/retirement); paper trail for large deposits; lenders must document income calculations in the permanent file.

Property Documents

➤ Executed purchase contract.

➤ Applicable property disclosures (seller’s disclosure, lead-based paint, sewer assessment, etc.)

➤ Appraisal (lender-ordered).

➤ Homeowners insurance binder prior to closing.

Program-Specific Add-Ons

➤ FHA: standard income/asset docs; lenders may use third-party verification but must still ensure quality (pay stubs, W-2s, bank statements).

➤ VA: Certificate of Eligibility (COE), DD-214/statement of service, and typical income/asset docs.

➤ USDA: verification of annual/adjusted/repayment income and assets per lender file requirements.

➤ KHC assistance (DAP): program forms and underwriting checklist in addition to first-mortgage docs.

KY Homebuyer Document Checklist (Instant Download)

Download our free Kentucky Homebuyer Mortgage Document Checklist (PDF) — a step-by-step guide to the ID, income, asset, and property papers lenders require.

Financing Q&As

The amount you need for a down payment depends on the type of loan and your financial situation. While 20% is a common benchmark, many buyers put down less—some conventional loans allow as little as 3%, and FHA loans require just 3.5%. KHC may help with down payment/closing costs.

Get Matched With a Lender (Fast Pre-Approval)

Ready to plan your budget and timeline? Get pre-approved by a trusted Kentucky lender—local pros will quote today’s rates, closing costs, and loan options in minutes,